Monday, March 30, 2009

Isolate your edge; don't just gamble, trade

Thursday, February 12, 2009

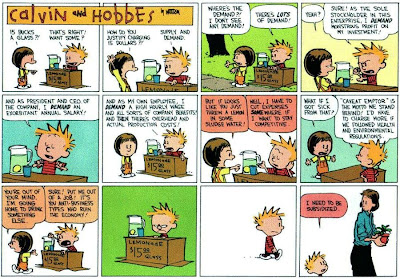

why are we in the lemonade business ?

Calvin (to Susie): Look at this glass of lemonade. You'll be able to sell it for 50 cents tomorrow, but I'll sell it to you for 25 cents today.

Susie: But I don't have the money.

Calvin: That's okay, I'll loan you the money. You can pay me back with interest... say... 35 cents. The lemonade will surely be worth 50 cents tomorrow... You can even drink part of it, sell the rest, and still be able to pay me back.

Susie: Well, I guess... you've been selling lemonade for so long, you should know.

Calvin: Here ya go.

Random kids: Wow, what an easy way to make dough! We'll take some of your lemonade too on exactly those terms.

Random kid: Hey, if I can get another kid to loan me money against the future value of this lemonade, I can invest it in lemons now and be a millionaire by the end of the day. Who knew getting rich is so easy?

(meanwhile just in eyeshot)

Moe 1 to Moe 2 (Rosalyn?, random kid?): I bet Susie won't be able to sell that lemonade tomorrow.

Moe 2: You're on.

Calvin to Moe 2: Say Moe 2, I just sold a bunch of lemonade and will get paid big time when they pay me for it, can I borrow some money to buy more lemons. I sure am glad lemonade's a fungible commodity.

Moe 2: Sure, I'll be making some dough when Susie won't be able to pay you back, so I feel comfortable loaning you more money now.

Mom: Geez, look at all that lemonade Calvin is selling... and if the Moe 2 is still lending him money, he must be doing something right. If I want to sell any lemonade I better do like he does so I don't lose any market share.

(next day)

Susie: Gee, I drank only a sip of that lemonade, and now no one wants to buy it. I won't be able to pay Calvin back completely. At least I got a sip... I'll pay him for that.

Calvin: Where's my money?

Susie: I couldn't sell your lemonade. But here's 15 cents... it's all I can pay.

Calvin: WHAT!?! But that beverage is so valuable... it's worth at least 50 cents.

Susie: Sorry, I know... I thought I would be able to make a fortune.

Calvin: Crap, me too. Well I'll have to take back what's left.

Susie: I don't think anyone else will want it.

Moe 2 (to Calvin): Where's my money?

Calvin: I don't have it. Here's some lemonade.

Moe 2: Don't have it? day-old lemonade? yuck.

Moe 2 (to Moe 1): see he doesn't have it, pay up.

Moe 1: I don't have any money, I was betting with those other kids that they'd be able to sell their lemonade, that was the only way I'd be able to pay you.

Moe 2: no money?

Moe 1: no money.

Calvin: Well I'd have some if you let me borrow some more.

Moe 2, Moe 1 and Calvin fall into a dust storm of fighting... Calvin narrowly escapes the fray

Mom: Geez things are hairy out there. I sure loaned out a lot of lemonade. I don't think I'm ever getting paid back. Now they'll all come whining to me about how they lost all their money and their lemonade.

Maybe Calvin's system isn't working out so hot, but If he has to shut down his lemonade stand, nobody will have lemonade ever.

Mom (to Calvin): Here, Calvin. This is 2 dollars. Buy some lemons and sugar.

Susie: I lost all my lemonade too, and my quarter, now I can't buy anything.

Mom (to Susie): Here Susie, this is 2 dollars, you should be able to plant a lemon tree with this, and you'll have all the lemonade you want. You can help me with chores if you want more.

(Mom continues paying out to all the neighborhood kids and the bullies for the blunder she and Calvin made.)

Mom: What the hell am I gonna do with all this day-old lemonade?

(later)

Dad: Where'd all our friggin money go? and What's with all this day-old lemonade. And why are you in the lemonade business to begin with?

Mom: What matters is that all the neighborhood kids have been made whole.

Dad: What do you mean... made whole‽ They took lemonade for free and then treated it as if it was worth a fortune to create an intricate web of bets and loans that ran the neighborhood economy into the ground.. and your answer is to dole out cash?

Mom: Well, we have to keep them occupied somehow or else they'll be in their houses bugging their parents and breaking things.

Dad: Well I guess you're right. We can't just do nothing

(elsewhere)

Calvin: MONEY MONEY MONEY MONEY!

Hobbes: Maybe you should try to just.. you know.. sell lemonade.

Calvin: But how am I supposed to make money doing that? I'm gonna sit on this wad of cash until Mom gets out of my hair, and then take Susie for all she has.

Wednesday, December 31, 2008

Quantitative Easing for Children

Quantitative easing from Marketplace on Vimeo.

more reasons not to fuck with TBT

AFAIK the gov't isn't buying treasuries at this point, though they've said they could. they buy agencies (GSEs).

via

http://www.stereohell.com/door/

also check this wonderful artwork:

http://www.stereohell.com/door/strip/

Friday, December 19, 2008

leveraged ETFs are for gambling

The purpose of trading is to determine the correct pricing for an equity. Traders buy and sell the thing and keep the price accurate and realistic (theoretically) or at least go probe the depths and heights of prices to see where people are going to freak out.

Think about the tape during the day. Those aren't all individuals making decisions. Most of those trades are machine driven, and most of THOSE aren't related to the immediately occurring price "discussion". They are to cover options, or as part of pair trades and vastly more exotic trading strategies. They are to cover warrants, to refill market makers' inventories, and in some cases to just swoop up a bunch of shares and hide them until later. Shares trade in dark pools of liquidity (cue eerie black metal soundtrack here — I suggest Burzum)

This is why the stock market is broken. Its not investing, its gambling, and the derivatives have selfishly removed the information component from the main market. Of course right now the information is this: we're fucked, its all over valued, sell sell sell !! Which is correct and as it should be. Would've been better if it had started a few years ago.

The Fly (as much he wouldn't admit it) has morals too:

While it’s true, being long 10,000 SRS on a 9 point day can be fun; it also can twist your stomach into knots when the opposite occurs, going up. For the love of large intestines and sanity, in 2009, “The Fly” will “go old school” and start short selling individual names directly, rather than through proxies.Of course I made loot off SKF 3 times this week, so ...

http://www.ibankcoin.com/flyblog/index.php/2008/12/19/no-more-volatility/

Thursday, December 4, 2008

if treasuries and USD sell off, what gets bought ?

the yuan can't handle it and wouldn't want to be pushed up that high. no currency buy itself can handle it. no equity market or sovereign bond market can handle it.

nobody wants the responsibility of all that investment. the problem in the world right now is too much "wealth" and no safe place to put it. (which reminds us how sad it is that poverty and resource-wars still plague the planet)

so reasons the sell off hasn't started:

1. if anybody flinches the game of confidence collapses and an amazing amount of "wealth" is destroyed in a sell off. nobody can step away from the table (except us little guys). any move has to be done very slowly and gradually.

2. there's nothing to sell this stuff off into

3. the big holders (esp. china, japan) benefit from a higher dollar for their export economies and the negative effect it has on commodities. they don't want the dollar to collapse. its in their best interests to keep loading up on this fictitious and nonredeemable wealth. everybody seems to think that the US is a real country with "balances" and obligations. its more like the bank in Monopoly.

disclosure: I gave up on TBT (short treasuries) with a small loss. the bubble gets bigger for now. it will move, the chart looks like it would move, but only as a trade. this is the age of VIX + 60. TBT is a long term move at some point. could be years.

and what a wicked world if everybody jumps on this one and bangs it into the ground. what would happen if the hedge funds put their momentum machines on treasuries and caused it all to squeeze out into some other unstable market ? greed is systematically destroying the financial world.

Tuesday, November 25, 2008

the world economy is electronically wired to fear and greed

yeah, that's it. I'm sure that with only fear and greed to act as inspiration, the men of earth will surely do the right thing with all of that human potential.

in the future we will see companies finding ways to avoid putting themselves public. like Porsche quietly buying up most of Volkswagen.

screw the gamblers, they have no sense of the history.

long: TBT, GLD

Tuesday, October 28, 2008

QLD QID quivering oddly

I used to scalp QLD/QID. Don't ask why, it just seemed like the thing to do. Now (Oct 2008) the bid ask is vibrating all over the place like water on a hot skillet. The only thing you can do is place a target in the range of quivering and hope it gets hit. The QQQQ is much more sensible and liquid and tradeable. I am always very curious what the software looks like that drives these things. What inputs are they keyed off of ?

I have learned that QLD etc. do not buy the actual underlying components of the index. Rather they have warrants with other parties who deliver the components to them with a certain amount of time displacement (possibly hours or days ?). Either that or they never own the underlying and have some queer deal with these warrant people.

In any case, you don't express yourself in the marketplace by buying ETFs. You might as well just do spread betting (very popular in the UK so I hear) or just go down t' pub and wager with your mates. Its certainly not investing. Your capital was never used for anything legitimate like paying wages or buying raw supplies. Your profits are only non-sensical gambling in the sphere of derivitaves of fake value.